ACTIVE DEBT RELIEF

Welcome to Active Debt Relief. Request You’re Free No Obligation Consultation Now!

If you’re struggling with debt, you might feel like there’s no way out. You’re not alone. According to a study conducted recently, the average American has over $38,000 in personal debt, not including mortgages. If you’re in this situation, you might want to consider meeting with a debt relief advisor. Here are some benefits to consider:

- Get a personalized plan A debt relief advisor can help you come up with a personalized plan to get out of debt. They’ll look at your income, expenses, and debt to come up with a plan that works for you. They can also give you tips on how to manage your money better in the future.

- Reduce your stress Debt can be incredibly stressful. It can keep you up at night and make it hard to focus on other aspects of your life. A debt relief advisor can help reduce your stress by giving you a plan to follow. You’ll know what steps to take to get out of debt, and you’ll have someone to guide you through the process.

- Save money A debt relief advisor can help you save money in the long run. They can negotiate with your creditors to reduce your interest rates or even settle your debts for less than what you owe. They can also help you create a budget and cut back on unnecessary expenses.

- Improve your credit score If you’re in debt, your credit score has likely taken a hit. A debt relief advisor can help you improve your credit score by getting you on a plan to pay off your debts. As you pay off your debts, your credit score will improve, which can open up more financial opportunities in the future.

- Avoid bankruptcy If you’re considering bankruptcy, a debt relief advisor can help you explore other options first. Bankruptcy should be a last resort because it can have long-term effects on your credit score and financial future. A debt relief advisor can help you find alternatives to bankruptcy, such as debt consolidation or debt settlement.

In conclusion, meeting with a debt relief advisor can have many benefits. You’ll get a personalized plan to get out of debt, reduce your stress, save money, improve your credit score, and avoid bankruptcy. If you’re struggling with debt, it’s worth considering meeting with a debt relief advisor to see how they can help you.

Active Debt Relief, a Company You Can Trust

More People Turn To Active Debt Relief & The Benefits.

We offer Way More. That’s Right, More Than Any Other Company!

MORE

SAVINGS

DEDICATED

ADVOCATES

ACTIVE

RESULTS

LIVE

ONLINE ACCESS

TOP RATED

PROGRAM

More People Trust Us, And For Good Reason

Over 1 Billion In Debt, Eliminated

Over 15 Thousand Clients Served

Over 49 Thousand Accounts Successfully Eliminated

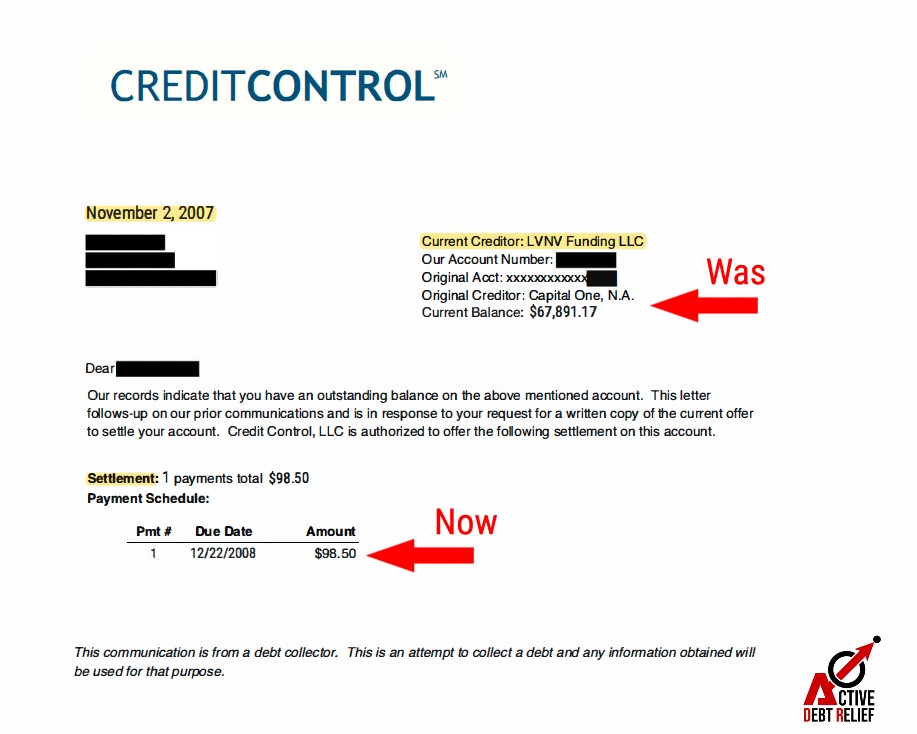

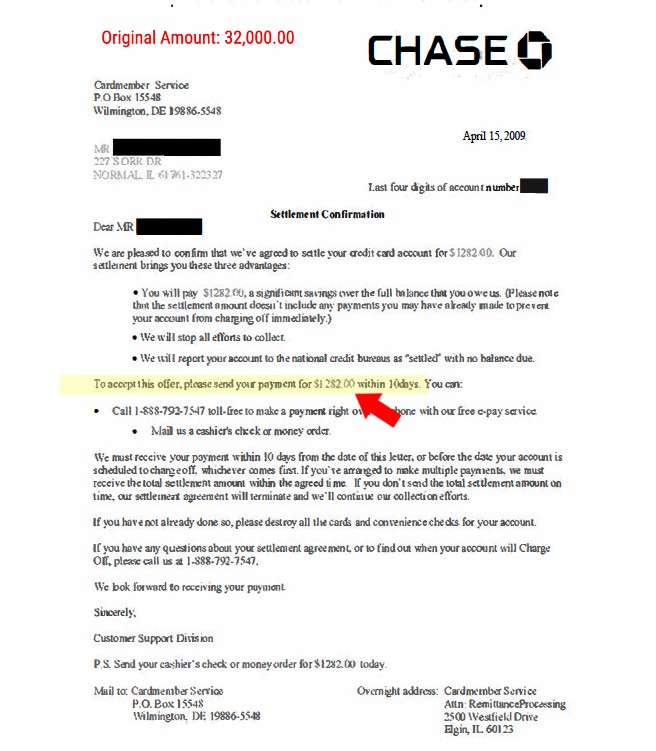

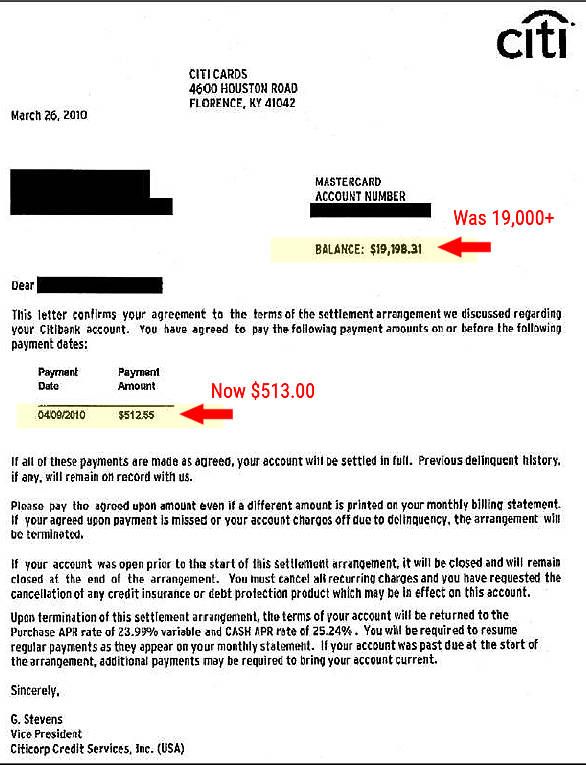

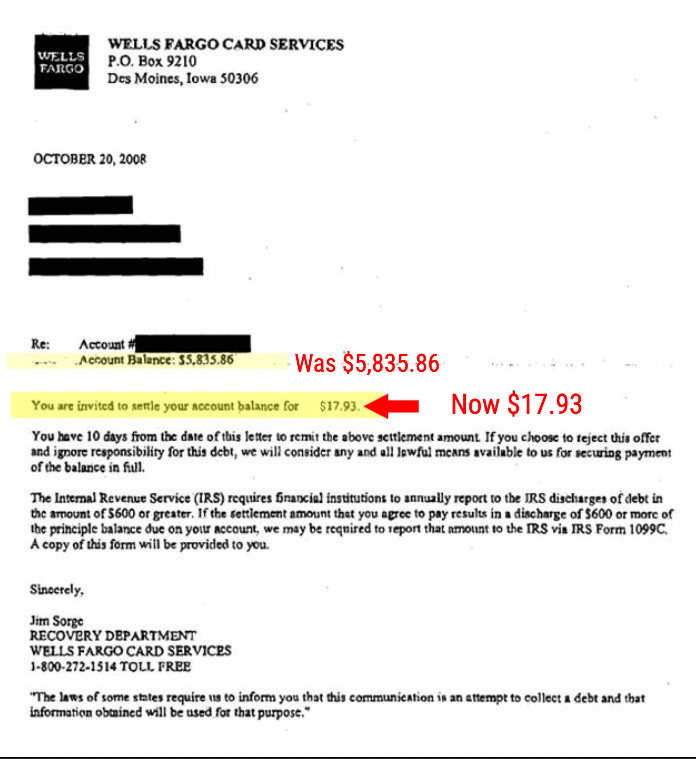

DON’T MERELY TAKE OUR WORD FOR IT, SEE FOR YOURSELF!

THE RESULTS ARE IN!!!

See What Our Clients Had to Say About Active Debt Relief

Active Debt Relief changed my life. They helped me eliminate 75,000 in Credit Card Debt in 9 Months. I don’t know where I would be without Active Debt Relief, and their assistance.

As I was in the hospital, in early 2013, I found myself burdened by credit card debt that had accumulated as a result. I was forced to put over 70 Thousand on a number of credit cards to payoff my life flight visit to the emergency room. Lucky for me I found Active Debt Relief to assist with my debt burden, they were heaven sent.

At the very minimum, I would say Active Debt Relief can be described as reliable, trusting, and outgoing. They never promised anything without a plan to deliver on it. The results were all I needed. I was lucky to find a program with real people and real results. Add me to the list of success stories this company has. I have only great things to say about Active Debt Relief.

ACTIVE DEBT RELIEF

PHONE: +1 (877) 706-2008

ADDRESSES:

55 W Wacker Dr Suite 100, Chicago, IL 60601

6363 Katella Ave, Cypress CA 90630

EMAIL: [email protected]

Professional debt negotiation is the process of negotiating with creditors to reduce and cancel overall debts. A strategic and successful negotiation occurs when the creditor agrees to cancel all or a large sum of the total account balance. Unsecured debts include medical bills and credit card debt and strategies can be integrated to eliminate debt that would not otherwise qualify. For the debtor, the debt negotiation done by an expert makes obvious sense.

Negotiating with a collection agency or junk debt buyer, is what Active Debt Relief does for you as well, and it is somewhat similar to negotiating with a credit card company or other original creditor. However, in our experience many collection agencies will agree to take even less of the owed amount than the original creditor, because they purchased the debt for a fraction of the original account.

As a part of the negotiation process, we offer a complete solution to both eliminate debt and restore your credit, as needed. We deal with the creditors, so you don’t have to. Our unique approach has one of the highest success records available. Additionally, we provide advantages that no one may provide.

Debt negotiation companies generally reduce amounts, but dont get as drastic results as Active Debt Relief does. Our results top competition results. Experienced debt negotiation companies typically have built up many relationships during their normal business practices with the credit card companies and can come to a negotiation agreement quicker and at a more favorable rate than a debtor acting on their own. For example, During the global financial crisis of 2008, more and more credit card companies were willing to settle existing credit card debts rather than add to their already large written off bad debt. Additionally, Legal action can be taken against the creditor if they violate the FDCP act. Take note that a good settlement company works with their clients to protect them. Like Active Debt Relief does. Debtors can be sued by creditors seeking to recover debts and interest. This can be avoided by using companies with good standings and practices that protect consumers from these procedures. A good debt negotiation company will handle calls from the credit card companies, and the collection agencies. Or stop them in their tracks, like we do. Don’t trust just anyone, trust Active Debt Relief. We are backed by experience and results.

Talk to an expert to learn more.

What is Debt Validation?

“Debt Elimination: The Smart Way to Cancel Debt using Debt Validation”

Are tired of struggling with debt? Do you want to take control of your finances and achieve debt elimination? If you answered yes, then you need to learn about debt validation. Debt validation is a legal process that requires debt collectors to provide proof of your debt. It’s a powerful tool that can help you cancel debt and achieve debt elimination. Here’s how it works: When a debt collector contacts you, they must provide you with a validation notice within five days. This notice should include information about the debt, such as the amount, the creditor’s name, and your right to dispute the debt. You then have 30 days to dispute the debt. During this time, you can request that the debt collector provide proof of your debt, such as the original agreement or contract.

If the debt collector cannot provide proof of your debt, then they cannot legally collect the debt from you. This means that the debt is canceled, and you are free of the burden of that debt. This is how debt validation can help you achieve debt elimination. Debt validation is not a quick fix for debt elimination. However, it can be an effective tool for those who are willing to put in the time and effort to use it. By understanding your rights and taking action to validate your debt, you can take control of your finances and achieve debt elimination. If you’re struggling with debt, don’t give up hope. There are options available to help you achieve debt elimination. Debt validation is a powerful tool that can help you take control of your finances and cancel debt. So take action today and start your journey towards debt elimination.

One of the most powerful tools you have under the Federal Fair Debt Collection Practices Act (FDCPA) is to require that a debt be verified. Creditors must verify the amount and validity of the debt it’s trying to collect. Overwhelmingly difficult for creditors, the use of this debt relief option assists in the process of eliminating debt in its entirety. The company is required to provide specific information in its first communication. Such as the amount of the debt, the name of the creditor, and a response to validating the debt that it originated properly. Compliance with the validation process is rarely followed by creditors, and if a creditor does not comply with the validation guidelines, they are in violation of communication required by law, subsequently the Creditor has five days from the initial contact to provide it to you. (15 U.S.C. § 1692g(a)).

One of the many reasons Debt Validation works is that once Validation is requested, all Collection Attempts Must Stop. If you send a written request for verification of the debt, the collection of all debts must stop all collection efforts, and can’t resume them. In accordance with a consumer’s right to dispute. (15 U.S.C. § 1692g(b)).

What are the Benefits to Debt Validation?

* It can be the least expensive debt relief option

*It can provide the option of a single affordable payment.

*Provides a Satisfaction Guarantee

*You defend yourself from illegal debt collection under the Fair Debt Collection Practices Act, the Credit Card Act, and the Fair Credit Billing Act

*Alleged debt collectors are forced to validate their right to collect on debt, and must validate that debt. If they not able to validate the debt, you don’t have to pay it

*Graduate the program in 24 months or less (on average).

*You will be provided with a nationally recognized debt relief support team, who’s available to assist you with updates and answers to all your questions. Available by phone or email.

Learn More About it, How Debt Validation Can Help

Requesting validation from the creditor provides grounds to dispute the debt. To the consumers’ benefit, collection agencies and creditors are busy. While verification might seem as if it should be easy, it can take several weeks or longer. Requesting verification is particularly helpful if the debt has been sold, especially if it has changed hands more than once. Often, debt buyers have little information about the debts they own. They might try to collect the wrong amount or from people with similar names who don’t owe the debt. If the debt collector can’t verify what you owe, you are then able to reduce or even eliminate the debt completely.

Does Debt Validation really work?

Yes, it does. When a debt collector receives a Debt Validation Letter, they are legally required to provide validation of the debt. Debt Validation Letter’s work best from us, because they include a cease and desist clause. When a creditor is forced into a position that is undesired, they are required to take action. Often times this action is to charge off or write off the debt as a loss, instead of pursuing it.

Should I use Debt Validation?

Nearly every time someone is contacted by a debt collector about a debt, they should send the collector a Debt Validation Letter. The letter forces the collector to treat you with respect and to get serious about the matter.

49 percent of all complaints filed with the FTC about debt collectors state the debt collector attempted to collect a debt that wasn’t owed. And 53 percent of people who are contacted by a debt collector say they’re being contacted about a debt they don’t owe or a debt of the wrong amount.

So, lots of people are being hounded by debt collectors for money they don’t owe. The Debt Validation Letter is your guardian.

If you don’t dispute the debt then “the debt will be assumed valid by the debt collector,” according to the FDCPA. That’s not good. By not filing a Debt Validation Letter, you are sacrificing your rights.

A Debt Validation Letter is beneficial in nearly all encounters with a collector.

-

If you don’t owe the debt, then the collector is likely to fold because they can’t provide validation of the debt.

-

If you only owe some of the debt, then the collector will be forced to prove the amount you actually owe. This can remove thousands of fraudulent dollars added on top of the actual debt.

-

If you owe the full debt, then the collector still may not be able to show proper documentation that you owe it, or they might not be able to show documentation that they own the debt and have the right to collect on it.

-

If the debt collector is able to validate the debt, then you will still benefit by having additional information about the debt. The letter will put you in a better place to negotiate a settlement. And you can request the collector cease contacting you.

To understand why a Debt Validation Letter is so important, it’s helpful to understand how the debt collection process works. Banks and lenders sell unpaid debts to debt collectors for 1%–10% of the value of the debt. Debt collectors then attempt to collect the debts from consumers. If they are unsuccessful, they may file a lawsuit to collect the debt. Frequently, the sale from the bank to the debt collector is poorly documented. So, the debt collector may be unable to verify they own the debt and unable to verify who owes the debt. If you send them a Debt Validation Letter, it makes it more difficult and more expensive for them to collect the debt. They need to keep their costs low to be profitable. This letter raises their costs, making it more likely they will fold.

In a few cases, it may be a good strategic move to lie low and not send a Debt Validation Letter. This may be a good option if the statute of limitations is nearing expiration. The statute of limitations is a limitation on the time an organization can attempt to collect on a debt or disable the creditor from ever being able to collect on a debt again.

Another benefit of the Debt Validation Letter is that it can make all calls stop or prevent calls. It can do this in two ways. Under FDCPA §809(b), if the letter disputes the debt, “collection activities and communications” must cease. Under FDCPA §805(c), the consumer can request the collector “cease further communication.” Debt validation works, simply because it increases the cost of collection and makes it so the creditor drops the case, or forces a write off of the debt entirely. To learn more about debt validation, contact a representative for more information.

What is Debt Validation?

One of the most powerful tools you have under the Federal Fair Debt Collection Practices Act (FDCPA) is to require that a debt be verified. Creditors must verify the amount and validity of the debt it’s trying to collect. Overwhelmingly difficult for creditors, the use of this debt relief option assists in the process of eliminating debt in its entirety.

The company is required to provide specific information in its first communication. Such as the amount of the debt, the name of the creditor, and a response to validating the debt that it originated properly.

Compliance with the validation process is rarely followed by creditors, and if a creditor does not comply with the validation guidelines, they are in violation of communication required by law, subsequently the Creditor has five days from the initial contact to provide it to you. (15 U.S.C. § 1692g(a)).

One of the many reasons Debt Validation works is that once Validation is requested, all Collection Attempts Must Stop. If you send a written request for verification of the debt, the collection of all debts must stop all collection efforts, and can’t resume them. In accordance with a consumer’s right to dispute. (15 U.S.C. § 1692g(b)).

What are the Benefits to Debt Validation?

* It can be the least expensive debt relief option

*It can provide the option of a single affordable payment.

*Provides a Satisfaction Guarantee

*You defend yourself from illegal debt collection under the Fair Debt Collection Practices Act, the Credit Card Act, and the Fair Credit Billing Act

*Alleged debt collectors are forced to validate their right to collect on debt, and must validate that debt. If they not able to validate the debt, you don’t have to pay it

*Graduate the program in 24 months or less (on average).

*You will be provided with a nationally recognized debt relief support team, who’s available to assist you with updates and answers to all your questions. Available by phone or email.

Learn More About it, How Debt Validation Can Help

Requesting validation from the creditor provides grounds to dispute the debt. To the consumers’ benefit, collection agencies and creditors are busy. While verification might seem as if it should be easy, it can take several weeks or longer. Requesting verification is particularly helpful if the debt has been sold, especially if it has changed hands more than once. Often, debt buyers have little information about the debts they own. They might try to collect the wrong amount or from people with similar names who don’t owe the debt. If the debt collector can’t verify what you owe, you are then able to reduce or even eliminate the debt completely.

Does Debt Validation really work?

Yes, it does. When a debt collector receives a Debt Validation Letter, they are legally required to provide validation of the debt. Debt Validation Letter’s work best from us, because they include a cease and desist clause. When a creditor

is forced into a position that is undesired, they are required to take action. Often times this action is to charge off or write off the debt as a loss, instead of pursuing it.

Should I use Debt Validation?

Nearly every time someone is contacted by a debt collector about a debt, they should send the collector a Debt Validation Letter. The letter forces the collector to treat you with respect and to get serious about the matter.

49 percent of all complaints filed with the FTC about debt collectors state the debt collector attempted to collect a debt that wasn’t owed. And 53 percent of people who are contacted by a debt collector say they’re being contacted about a debt they don’t owe or a debt of the wrong amount.

So, lots of people are being hounded by debt collectors for money they don’t owe. The Debt Validation Letter is your guardian.

If you don’t dispute the debt then “the debt will be assumed valid by the debt collector,” according to the FDCPA. That’s not good. By not filing a Debt Validation Letter, you are sacrificing your rights.

A Debt Validation Letter is beneficial in nearly all encounters with a collector.

-

If you don’t owe the debt, then the collector is likely to fold because they can’t provide validation of the debt.

-

If you only owe some of the debt, then the collector will be forced to prove the amount you actually owe. This can remove thousands of fraudulent dollars added on top of the actual debt.

-

If you owe the full debt, then the collector still may not be able to show proper documentation that you owe it, or they might not be able to show documentation that they own the debt and have the right to collect on it.

-

If the debt collector is able to validate the debt, then you will still benefit by having additional information about the debt. The letter will put you in a better place to negotiate a settlement. And you can request the collector cease contacting you.

To understand why a Debt Validation Letter is so important, it’s helpful to understand how the debt collection process works. Banks and lenders sell unpaid debts to debt collectors for 1%–10% of the value of the debt. Debt collectors then attempt to collect the debts from consumers. If they are unsuccessful, they may file a lawsuit to collect the debt. Frequently, the sale from the bank to the debt collector is poorly documented. So, the debt collector may be unable to verify they own the debt and unable to verify who owes the debt. If you send them a Debt Validation Letter, it makes it more difficult and more expensive for them to collect the debt. They need to keep their costs low to be profitable. This letter raises their costs, making it more likely they will fold.

In a few cases, it may be a good strategic move to lie low and not send a Debt Validation Letter. This may be a good option if the statute of limitations is nearing expiration. The statute of limitations is a limitation on the time an organization can attempt to collect on a debt or disable the creditor from ever being able to collect on a debt again.

Another benefit of the Debt Validation Letter is that it can make all calls stop or prevent calls. It can do this in two ways. Under FDCPA §809(b), if the letter disputes the debt, “collection activities and communications” must cease. Under FDCPA §805(c), the consumer can request the collector “cease further communication.” Debt validation works, simply because it increases the cost of collection and makes it so the creditor drops the case, or forces a write off of the debt entirely. To learn more about debt validation, contact a representative for more information.

Are you tired of struggling to pay off your debts? Are you tired of dealing with harassing phone calls and letters from debt collectors? If so, then debt validation may be the best debt relief option for you.

Debt validation is a legal process that requires debt collectors to provide proof that they have the right to collect on a debt. This process can be used to challenge the validity of a debt or to negotiate a settlement with a creditor.

Here are some reasons why debt validation is the best debt relief option:

- Stops Harassment from Debt Collectors

When you request debt validation, debt collectors are required to stop all collection activity until they provide you with the requested information. This means no more harassing phone calls, letters, or threats from debt collectors.

- Provides an Opportunity to Negotiate a Settlement

Debt validation can also be used as a negotiating tool. If a debt collector is unable to provide proof that they have the right to collect on a debt, you may be able to negotiate a settlement for a lower amount or better repayment terms.

- Helps Protect Your Credit Score

When you dispute a debt through debt validation, the debt should be removed from your credit report until the debt collector provides proof that they have the right to collect on the debt. This can help protect your credit score from being negatively impacted by an inaccurate or unfair debt.

- Saves Money in the Long Run

By using debt validation to negotiate a settlement or dispute a debt, you may be able to save money in the long run. Settling a debt for a lower amount or negotiating better repayment terms can help you avoid paying high interest rates, collection fees, and other expenses associated with debt.

In conclusion, debt validation is a powerful tool that can help you escape the burden of debt. It can protect you from harassment from debt collectors, provide an opportunity for negotiation, protect your credit score, and save you money. So, if you’re struggling with debt, consider using debt validation as your best debt relief option.

Debt settlement is a process where a debtor negotiates with their creditor(s) to pay off a portion of their outstanding debt in exchange for the creditor(s) agreeing to forgive the remaining balance. This type of debt relief is most commonly used for unsecured debt, such as credit card debt, medical bills, and personal loans. Debt settlement has several benefits for those who are struggling with debt, and it can be an effective way to get back on track financially.

One of the biggest benefits of debt settlement is that it can help individuals avoid bankruptcy. Bankruptcy can have serious long-term consequences on a person’s credit score and financial future. Debt settlement allows individuals to negotiate with their creditors and avoid the negative impact of bankruptcy. By settling their debt, individuals can reduce the amount of debt they owe and avoid the long-term consequences of bankruptcy.

Another benefit of debt settlement is that it can help individuals save money. When individuals negotiate with their creditors to settle their debt, they often pay less than the full amount owed. This can result in significant savings for individuals who are struggling with debt. Additionally, debt settlement can help individuals avoid high-interest rates and fees associated with late payments and delinquent accounts.

Debt settlement can also help individuals regain control of their finances. When individuals are struggling with debt, it can be difficult to keep up with payments and stay on top of their finances. Debt settlement allows individuals to take control of their debt and develop a plan to pay off their remaining debt. This can provide a sense of relief and help individuals feel more confident in their financial situation.

Another benefit of debt settlement is that it can improve credit scores. While debt settlement can have a negative impact on credit scores in the short term, it can also have a positive impact in the long term. By settling their debt, individuals can reduce the amount of debt they owe and improve their credit utilization ratio, which can have a positive impact on their credit score. Additionally, settling debt can help individuals avoid negative marks on their credit report, such as collections and charge-offs, which can have a significant impact on credit scores.

Debt settlement can also help individuals avoid harassment from creditors and debt collectors. When individuals are struggling with debt, they may receive calls and letters from creditors and debt collectors. These calls and letters can be stressful and overwhelming, and can even lead to legal action. Debt settlement can help individuals avoid harassment from creditors and debt collectors by negotiating with them directly and developing a plan to pay off their debt.

Finally, debt settlement can provide individuals with peace of mind. When individuals are struggling with debt, it can be difficult to focus on anything else. Debt settlement can provide individuals with a sense of relief and allow them to focus on other aspects of their life, such as their family, career, and hobbies.

In conclusion, debt settlement has several benefits for those who are struggling with debt. It can help individuals avoid bankruptcy, save money, regain control of their finances, improve credit scores, avoid harassment from creditors and debt collectors, and provide peace of mind. While debt settlement is not the right solution for everyone, it can be an effective way to get back on track financially and achieve financial freedom. If you are struggling with debt, consider reaching out to a debt settlement company or a financial advisor to discuss your options and develop a plan to pay off your debt.

Again, Debt settlement is a process where a debtor and creditor agree to settle a debt for less than what is owed. This can be a beneficial solution for individuals who are struggling with debt and looking for a way to manage their financial situation.

One of the main benefits of debt settlement is that it can help individuals to avoid bankruptcy. Bankruptcy is a legal process that can be a long and expensive process. Debt settlement can be a quicker and more affordable alternative for those who are facing financial hardship. By negotiating with creditors, individuals can reduce their debt and avoid the long-term consequences of bankruptcy.

Another benefit of debt settlement is that it can help individuals to avoid damaging their credit score. When individuals fall behind on their debt payments, their credit score can be negatively impacted. This can make it difficult for them to obtain credit in the future. However, by negotiating a settlement with creditors, individuals can avoid the negative impact on their credit score and begin to rebuild their credit history.

Debt settlement can also provide individuals with a sense of financial relief. When individuals are struggling with debt, it can be a stressful and overwhelming experience. By settling their debt, they can reduce the amount of money they owe and alleviate some of the financial pressure they are facing. This can provide individuals with a sense of peace of mind and allow them to focus on other aspects of their lives.

The process of debt settlement typically involves negotiating with creditors to agree on a reduced payment plan. This can involve working with a debt settlement company or negotiating directly with the creditor. The creditor may be willing to accept a lump sum payment or a payment plan that is less than the full amount owed. Once a settlement is agreed upon, the debtor will make payments to the creditor until the debt is fully paid off.

Debt settlement is not without its risks and drawbacks, however. It can be a complex process that requires careful consideration and planning. Individuals may also face tax consequences as forgiven debt may be considered taxable income by the IRS. Additionally, debt settlement can negatively impact an individual’s credit score, although not as severely as bankruptcy.

In order to determine if debt settlement is the right solution for their financial situation, individuals should carefully consider all of their options and consult with a financial professional. It is important to understand the risks and benefits of debt settlement before making a decision.

In conclusion, debt settlement can provide individuals with a way to manage their debt and avoid bankruptcy. It can help individuals to avoid damaging their credit score, provide a sense of financial relief, and allow them to focus on other aspects of their lives. However, it is important to carefully consider the risks and benefits of debt settlement before making a decision. By working with a financial professional and taking the time to fully understand the process, individuals can make an informed decision and take control of their financial future.

Debt Consolidation: The Ultimate Solution to Your Financial Worries

Are you struggling to keep up with multiple loan repayments and drowning in debt? Do you feel like your finances are spiraling out of control? If yes, then debt consolidation might be the perfect solution for you. Debt consolidation allows you to merge all your debts into a single loan, which can make your monthly repayments more manageable and reduce your overall interest charges. In this article, we will discuss the benefits of debt consolidation and how it works.

Benefits of Debt Consolidation:

-

Lower Interest Rates: Debt consolidation allows you to combine all your loans into a single loan with a lower interest rate. This means that you will be paying less interest overall, which can save you a lot of money in the long run.

-

Simplify Your Finances: Managing multiple debts can be a hassle. Debt consolidation allows you to simplify your finances by consolidating all your debts into one loan. This means that you will only have to make one payment each month instead of multiple payments to different creditors.

-

Reduce Monthly Payments: Debt consolidation can help reduce your monthly payments by spreading them out over a longer period of time. This can provide relief to your budget and make it easier to manage your monthly expenses.

-

Improve Credit Score: Debt consolidation can improve your credit score by reducing the number of accounts you have open and the amount of debt you owe. This can improve your credit utilization ratio, which is a major factor in determining your credit score.

How Debt Consolidation Works:

Debt consolidation works by combining multiple loans into a single loan. This can be done in several ways:

-

Personal Loan: You can take out a personal loan to pay off your existing debts. This new loan will have a lower interest rate than your previous debts, which can save you money in the long run.

-

Balance Transfer: You can transfer the balances of your credit card debts to a new credit card with a lower interest rate. This can help you save money on interest charges and reduce your monthly payments.

-

Home Equity Loan: You can take out a home equity loan, which is a loan that is secured by the equity in your home. This type of loan typically has a lower interest rate than other types of loans.

Sales Pitch:

Debt consolidation can be a life-changing solution for those who are struggling with debt. It can help you lower your interest rates, simplify your finances, reduce your monthly payments, and improve your credit score. At [Company Name], we specialize in debt consolidation and can help you find the perfect solution to your financial worries. Our team of experts will work with you to understand your unique financial situation and recommend the best debt consolidation option for you. Don’t let debt control your life any longer. Contact us today to learn more about how debt consolidation can help you take control of your finances and live a debt-free life!

Here are some of the benefits of using a company that also offers credit repair:

- Expertise and Experience

Credit repair companies have experts who are knowledgeable in the laws and regulations related to credit repair. They know how to navigate the credit reporting agencies, credit bureaus, and creditors to effectively dispute negative items on your credit report. With their experience, they can identify errors or inaccuracies on your credit report that you might miss, which can improve your credit score.

- Time Savings

Repairing your credit on your own can be a daunting task, especially if you have limited knowledge of the process. Credit repair companies can save you time by handling the dispute process on your behalf. They will gather all the necessary information and documentation, draft dispute letters, and follow up with the credit bureaus and creditors. This means you can focus on other important things in your life, like your job or family, while the credit repair company handles the rest.

- Improved Credit Score

The ultimate goal of using a credit repair company is to improve your credit score. A higher credit score can open doors to better financial opportunities, such as lower interest rates on loans, higher credit limits, and even better job offers. Credit repair companies can dispute negative items on your credit report, such as late payments, collections, and charge-offs, which can have a significant impact on your credit score.

- Debt Management

Credit repair companies can also help you manage your debt by providing you with financial education and resources. They can help you create a budget and develop a debt management plan to pay off your debts and improve your credit score. This can save you money in the long run by avoiding high-interest rates and penalties.

So, how does it work?

First, you will need to choose a reputable credit repair company. Look for companies that have a proven track record of success and have positive reviews from previous clients. Once you have selected a company, they will review your credit report and identify any negative items that can be disputed. They will then draft dispute letters and send them to the credit bureaus and creditors on your behalf. The credit bureaus and creditors have 30 days to respond to the dispute, and if they cannot verify the negative item, it will be removed from your credit report.

In conclusion, using a credit repair company can be a game-changer for your financial future. It can save you time and money, improve your credit score, and provide you with the resources you need to manage your debt. Don’t let a low credit score hold you back from achieving your goals. Contact us today to learn more about how we can help you repair your credit and improve your financial health.

Are you feeling overwhelmed by debt and considering bankruptcy as your only option? Before you make that drastic decision, let me introduce you to a better alternative – debt validation.

Debt validation is the process of requesting that a creditor provide proof of the debt they claim you owe. This is done by sending a written letter known as a debt validation letter to the creditor or collection agency. By doing this, you can verify that the debt is legitimate and that you owe the amount claimed.

So, why is debt validation a better option than bankruptcy? For starters, filing for bankruptcy can have serious long-term consequences on your credit score and financial future. A bankruptcy will stay on your credit report for up to 10 years and make it difficult to obtain credit or loans in the future. On the other hand, debt validation is a less drastic option that can help you avoid bankruptcy and protect your credit.

Furthermore, debt validation can potentially reduce or eliminate your debt altogether. In some cases, creditors are unable to provide the necessary documentation to prove the debt, and it can be dismissed entirely. Even if the debt is valid, debt validation can give you the opportunity to negotiate a lower payoff amount or work out a more manageable payment plan.

Debt validation is also a legal right afforded to you under the Fair Debt Collection Practices Act (FDCPA). If a creditor or collection agency violates your rights under the FDCPA, you may be entitled to legal recourse and financial compensation.

At this point, you might be wondering how to get started with debt validation. The process can be complex and time-consuming, which is why it’s important to work with a reputable debt validation service like Active Debt Relief. Our team of experts has years of experience helping clients validate their debts and negotiate with creditors.

When you work with Active Debt Relief, we’ll start by analyzing your debt and determining which debts are eligible for validation. We’ll then draft a debt validation letter and send it to your creditors on your behalf. From there, we’ll work with your creditors to negotiate a settlement that works for you.

In conclusion, if you’re considering bankruptcy as a solution to your debt problems, debt validation may be a better option. Not only can it protect your credit and financial future, but it can also potentially reduce or eliminate your debt. Contact Active Debt Relief today to learn more about how we can help you with debt validation.

Active Debt Relief © 2024 | All Rights Reserved